By: Monica Fritsch

On April 5, 2021, the U.S. Court of International Trade (“the CIT”) determined Trump-era expansions to tariffs on certain steel and aluminum imports violated procedural requirements of Section 232 of the Trade Expansion Act of 1962; therefore, the government must revoke these duties and refund the importers.[1] Section 232 of the Trade Expansion Act of 1962, codified at 19 U.S.C. § 1862, allows a president to implement duties on imports that threaten national security.[2] This section allows any interested party to request the Department of Commerce initiate an investigation to determine whether a specific import is causing a negative impact on U.S. national security.[3] Section 232 lays out a precise schedule for the investigation and implementation of any action, which the CIT continually applies very strictly.[4]

Prior to former President Trump’s revival of this duty-implementing procedure, Section 232 had not been used to implement duties since 1986.[5] However, following his trend of protectionism for domestic industries, former President Trump initiated five separate investigations under this section.[6] As of December 2020, two of these investigations are ongoing, and one was terminated upon a negative finding.[7]

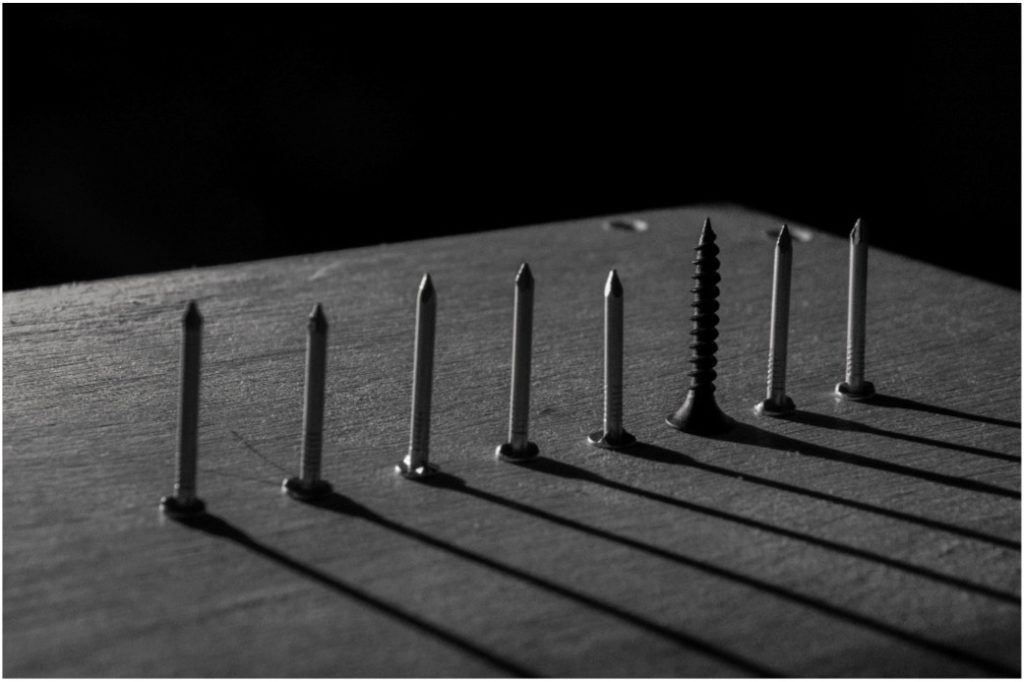

One of these investigations resulted in Presidential Proclamation 9705, which imposed a twenty-five percent duty on steel and a ten percent duty on aluminum.[8] The CIT upheld these duties as proper under Section 232 and the Administrative Procedure Act in February.[9] Importers criticized these duties as an overbroad interpretation of Section 232’s power.[10] Approximately two years later, former President Trump issued Presidential Proclamation 9980, which expanded the duties to include finished steel and aluminum products, such as nails.[11] However, former President Trump issued the proclamation after Section 232(c)(1)’s 105-day time period in which the President can issue duties after receiving the Department of Commerce’s Report.[12]

The CIT acknowledged that the increased duties under Presidential Proclamation 9980 violated Section 232’s procedural requirements but noted there was still an issue of material fact.[13] While no formal investigation was re-opened into these steel and aluminum products, the CIT wondered whether any discussions between former President Trump and the Department of Commerce regarding these duties might have informally re-opened the investigation window and gave the government the opportunity to make this argument in a later status report.[14] However, in its March 2021 Joint Status Report, the United States maintained that former President Trump’s amended duties complied with Section 232 and that there was no further investigation by Commerce.[15] Thus, having already rejected the argument that the duties complied with Section 232’s procedural requirements in Primesource I, the CIT granted summary judgment as a matter of law sua sponte on April 5, 2021, finding the duties on certain steel and aluminum products, such as nails, inconsistent with Section 232; therefore, unlawful.[16]

This ruling will directly affect the steel and aluminum industry.[17] As required by statute, the US must remove Presidential Proclamation 9980 duties on certain finished steel and aluminum products, such as nails, and the importers allowed reliquidation with interest for any duties they previously paid on these goods.[18] This means that the relative price of imported steel and aluminum products will fall to a pre-duty level, making them more competitive to domestically produced steel and aluminum products. Further, this outcome was termed “a rare legal victory” for the importers.[19] It is possible that this outcome may lead other importers to attempt to bring their cases about duties their products are subjected to the CIT, raising any procedural defect they believe may lead to the removal of tariffs.[20]

[1] Primesource Building Products, Inc. v. United States, No. 20-00032, slip. op. at 11– 12 (Ct. Int’l Trade April 5, 2021), https://www.cit.uscourts.gov/sites/cit/files/21-36.pdf.

[2] 19 U.S.C. § 1862.

[3] See Rachel F. Fefer, Cong. Rsch. Serv., IF10667, Section 232 of the Trade Expansion Act of 1962 (2020), https://fas.org/sgp/crs/misc/IF10667.pdf.

[4] See id.; see also Alex Lawson, Trade Court Strikes Expanded Security Steel Tariffs, Law360 (April 5, 2021, 3:52 PM), https://www.law360.com/amp/articles/1372280.

[5] See Fefer, supra note 3.

[6] Id.

[7] Id.

[8] Frances P. Hadfield et al., U.S. Court of International Trade (CIT) Upholds Section 232 Tariffs, Crowell & Moring LLP (Feb 4, 2021), https://www.lexology.com/library/detail.aspx?g=b8eeed70-4010-4448-bd08-e59c4d8cf1a0.

[9] Id.

[10] See id.

[11] See Lawson, supra note 4.

[12] Primesource Building Products, Inc. v. United States, No. 20-00032, slip. op. at 44–45, 50 (Ct. Int’l Trade Jan. 27, 2021), https://www.cit.uscourts.gov/sites/cit/files/21-08-A1.pdf.

[13] Id. at 54.

[14] Id. (stating that there are “genuine issues of material fact” as to whether a later assessment by the Department of Commerce on the Proclamation 9980 duties occurred, which could make these duties Section 232 compliant).

[15] Primesource Building Products, Inc. v. United States, No. 20-00032, slip. op. at 6–7 (Ct. Int’l Trade April 5, 2021), https://www.cit.uscourts.gov/sites/cit/files/21-36.pdf.

[16] Id. at 11–12.

[17] Mahmood Mohammed Sharif, Economic Impact of US Tariffs on Steel and Aluminum Import, Trends (Mar. 4, 2020), https://trendsresearch.org/insight/economic-impact-of-us-tariffs-on-steel-and-aluminum-import/ (stating that the removal of tariffs will increase competition between domestic steel and imported steel).

[18] See id. at 12.

[19] See Lawson, supra note 4 (stating that steel importer victory against Section 232 tariffs, which President Biden continues to impose, is “rare”).

[20] See id. (noting that eleven other companies impacted by Presidential Proclamation 9980’s expanded duties also filed suit).